19++ Free cash flow formula from net income for Lockscreen

Home » Wallpaper » 19++ Free cash flow formula from net income for LockscreenFree cash flow formula from net income information are available. Free cash flow formula from net income are a topic that is being searched for and liked by netizens now. You can Get the Free cash flow formula from net income files here. Download all free photos.

If you’re searching for free cash flow formula from net income pictures information connected with to the free cash flow formula from net income interest, you have visit the ideal blog. Our site frequently gives you suggestions for viewing the maximum quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

Free Cash Flow Formula From Net Income, Free cash flow is a particularly good indicator of whether a company can pay back its debts, or maintain or even grow its dividend payments. Here is the formula to calculate fcfe from net income: Find out the free cash flow to equity of the firm. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders.

University Assessment And Improvement Report Writing From pinterest.com

University Assessment And Improvement Report Writing From pinterest.com

The key difference between the two is that cash flow is the net of amount of cash or cash equivalents cycling in and out of the company. If start from net income, we use the following formula: The generic free cash flow fcf formula is equal to cash from operations cash flow from operations cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow, whereas, net income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. Each company is a bit different, but a “formula” for unlevered free cash flow would look like this:

The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing.

The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow. Discounted cash flow (dcf) valuation views the intrinsic value of a security as the present value of its expected future cash flows. Example of free cash flow calculation Let’s take a look at an example of that formula in the real world. Unlevered free cash flow formula. The free cash flow to equity formula is used to calculate the equity available to shareholders after accounting for the expenses to continue operations and future capital needs for growth. With that knowledge in hand, the basic formula for free cash flow looks like this:

Source: pinterest.com

Source: pinterest.com

Preventive Maintenance Schedule Template New Preventive Unlevered free cash flow formula. free cash flow = net operating profit after taxes − net investment in operating capital where: Unlevered free cash flow formula. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Find out the free cash flow to equity of the firm. The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow.

Source: pinterest.com

Source: pinterest.com

The assignment experts providing accounting assignment The key difference between the two is that cash flow is the net of amount of cash or cash equivalents cycling in and out of the company. Discounted cash flow (dcf) valuation views the intrinsic value of a security as the present value of its expected future cash flows. The free cash flow to equity formula is used to calculate the equity available to shareholders after accounting for the expenses to continue operations and future capital needs for growth. Example of free cash flow calculation To calculate the fcfe from net income, we need to look at the formula and break it down. Calculating free cash flow free cash flow formula can be understood as below:

Source: pinterest.com

Source: pinterest.com

Live Web Experts is a remarkable online academic services Let’s take a look at an example of that formula in the real world. Let’s take a look at an example of that formula in the real world. To calculate the fcfe from net income, we need to look at the formula and break it down. Each company is a bit different, but a “formula” for unlevered free cash flow would look like this: With that knowledge in hand, the basic formula for free cash flow looks like this: Our coverage extends dcf analysis to value a company and its equity securities by valuing free cash flow.

Source: pinterest.com

Source: pinterest.com

Printable Automotive Repair Receipts Infocap Ltd. for Free cash flow is used in the various number of ways primarily by investors to gain insights on the health of a company and also to value the company as a whole. When applied to dividends, the dcf model is the discounted dividend approach or dividend discount model (ddm). To calculate the fcfe from net income, we need to look at the formula and break it down. Calculating free cash flow free cash flow formula can be understood as below: To calculate free cash flow, all you need to do is turn to a company�s financial statements such as the statement of cash flows and use the following fcf formula: Example of free cash flow calculation

Source: in.pinterest.com

Source: in.pinterest.com

Calculating Free Cash Flow in 2020 Cash flow, Free cash Each company is a bit different, but a “formula” for unlevered free cash flow would look like this: Unlevered free cash flow formula. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow, whereas, net income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. Example of free cash flow calculation Here is the formula to calculate fcfe from net income: Discounted cash flow (dcf) valuation views the intrinsic value of a security as the present value of its expected future cash flows.

Source: pinterest.com

Source: pinterest.com

How to Estimate Start Up Assets Plan Projections in 2020 Free cash flow is commonly confused with cash flow which appears on the cash flow statement. To calculate free cash flow for a stock, you first need to find two numbers: Further, free cash flow is used in free cash flow model for business valuation. The formula used for calculation of free cash flow depends on whether we are starting from net income or from net cash flows from operating activities. The key difference between the two is that cash flow is the net of amount of cash or cash equivalents cycling in and out of the company. Free cash flow to equity (fcfe) can be calculated in many ways.

Source: pinterest.com

Source: pinterest.com

Energy Consumption Calculator Template Excel Excel To calculate free cash flow, all you need to do is turn to a company�s financial statements such as the statement of cash flows and use the following fcf formula: The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow. Free cash flow is a particularly good indicator of whether a company can pay back its debts, or maintain or even grow its dividend payments. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow, whereas, net income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders. Our coverage extends dcf analysis to value a company and its equity securities by valuing free cash flow.

Source: pinterest.com

Source: pinterest.com

Deferred Revenue Bookkeeping Terminology ATB Let’s take a look at an example of that formula in the real world. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow is commonly confused with cash flow which appears on the cash flow statement. The free cash flow to equity formula is used to calculate the equity available to shareholders after accounting for the expenses to continue operations and future capital needs for growth. When applied to dividends, the dcf model is the discounted dividend approach or dividend discount model (ddm).

Source: pinterest.com

Source: pinterest.com

Unique Simple Gpa Calculator exceltemplate xls In contrast, net income measures the business’s profitability, a general measure of how efficiently it uses its resources to produce revenues while keeping ahead of the expenses spent to produce those revenues. Each company is a bit different, but a “formula” for unlevered free cash flow would look like this: As you can see, the free cash flow equation is pretty simple. Fcfe from net income formula. Further, free cash flow is used in free cash flow model for business valuation. Let’s take a look at an example of that formula in the real world.

Source: pinterest.com

Source: pinterest.com

Basic Statement Template Beautiful Basic In E To calculate free cash flow, all you need to do is turn to a company�s financial statements such as the statement of cash flows and use the following fcf formula: Since net income has been provided to us, let’s solve for fcfe using the formula: Our coverage extends dcf analysis to value a company and its equity securities by valuing free cash flow. Equation for calculate free cash flow is,. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow is commonly confused with cash flow which appears on the cash flow statement.

Source: pinterest.com

Source: pinterest.com

14+ Cash Flow Statement Templates Cash flow statement Calculating free cash flow free cash flow formula can be understood as below: What is the free cash flow (fcf) formula? A positive or negative cash flow gives investors an understanding of how a company is performing financially. Since net income has been provided to us, let’s solve for fcfe using the formula: Find out the free cash flow to equity of the firm. Here is the formula to calculate fcfe from net income:

Source: pinterest.com

Source: pinterest.com

Personal Financial Statements Template Best Of 40 Personal Since net income has been provided to us, let’s solve for fcfe using the formula: Start with operating income (ebit) on the company’s income statement. Free cash flow to equity (fcfe) can be calculated in many ways. The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow. Free cash flow is a particularly good indicator of whether a company can pay back its debts, or maintain or even grow its dividend payments. The ocf portion of the equation can be broken down and be calculated separately by subtracting the any taxes due and change in net working capital from ebitda.

Source: pinterest.com

Source: pinterest.com

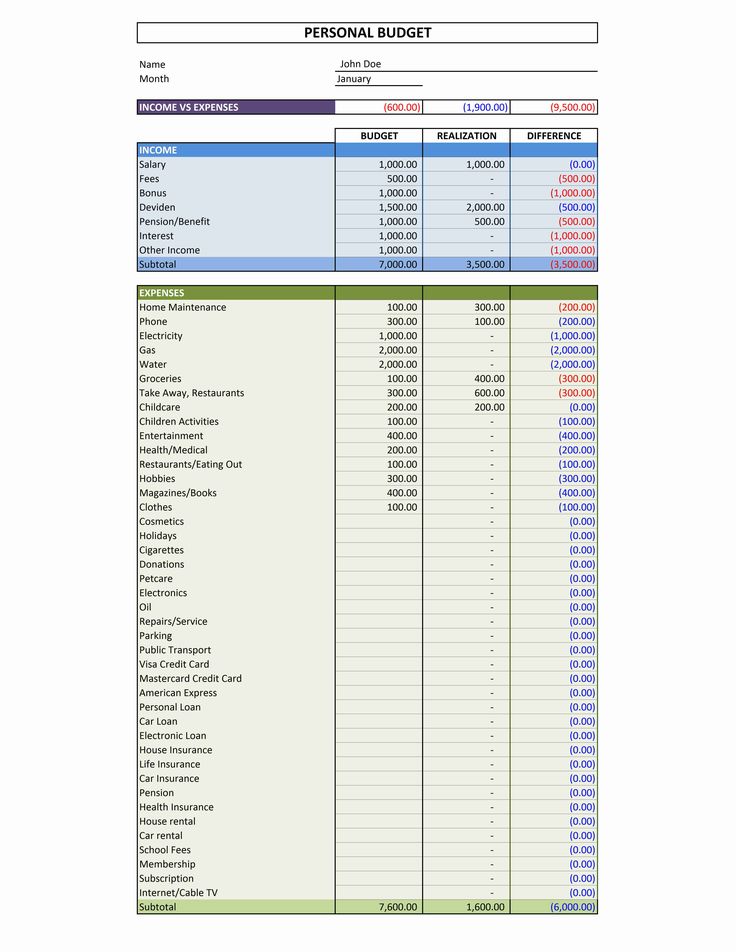

Personal Budget Event planning spreadsheet What is the free cash flow (fcf) formula? Fcfe from net income formula. Cash flow from operations and capital expenditures. The free cash flow to equity formula is used to calculate the equity available to shareholders after accounting for the expenses to continue operations and future capital needs for growth. Free cash flow to equity (fcfe) can be calculated in many ways. Each company is a bit different, but a “formula” for unlevered free cash flow would look like this:

Source: pinterest.com

Source: pinterest.com

What’s the formula for calculating free cash flow? Free When applied to dividends, the dcf model is the discounted dividend approach or dividend discount model (ddm). Each company is a bit different, but a “formula” for unlevered free cash flow would look like this: As you can see, the free cash flow equation is pretty simple. Equation for calculate free cash flow is,. Let’s take a look at an example of that formula in the real world. With that knowledge in hand, the basic formula for free cash flow looks like this:

Source: br.pinterest.com

Source: br.pinterest.com

Data Management Plan Template Inspirational 11 Data The key difference between the two is that cash flow is the net of amount of cash or cash equivalents cycling in and out of the company. Our coverage extends dcf analysis to value a company and its equity securities by valuing free cash flow. To calculate free cash flow, all you need to do is turn to a company�s financial statements such as the statement of cash flows and use the following fcf formula: Start with operating income (ebit) on the company’s income statement. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow, whereas, net income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. Free cash flow to equity (fcfe) can be calculated in many ways.

Source:

Source:

Personal net worth calculator Templates and more Start with operating income (ebit) on the company’s income statement. In contrast, net income measures the business’s profitability, a general measure of how efficiently it uses its resources to produce revenues while keeping ahead of the expenses spent to produce those revenues. Each company is a bit different, but a “formula” for unlevered free cash flow would look like this: Where, f = free cash flow n = net income d = changes in working capital a = amortization / depreciation Calculating free cash flow free cash flow formula can be understood as below: Here is the formula to calculate fcfe from net income:

Source: pinterest.com

Source: pinterest.com

Automotive Repair Invoice Templates Best Of Auto Repair With that knowledge in hand, the basic formula for free cash flow looks like this: Further, free cash flow is used in free cash flow model for business valuation. With that knowledge in hand, the basic formula for free cash flow looks like this: The ocf portion of the equation can be broken down and be calculated separately by subtracting the any taxes due and change in net working capital from ebitda. Fcfe from net income formula. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders.

Source: pinterest.com

Source: pinterest.com

Free Cash Flow Statement Templates Cash flow statement The generic free cash flow fcf formula is equal to cash from operations cash flow from operations cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time. When applied to dividends, the dcf model is the discounted dividend approach or dividend discount model (ddm). The ocf portion of the equation can be broken down and be calculated separately by subtracting the any taxes due and change in net working capital from ebitda. The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow. free cash flow = net operating profit after taxes − net investment in operating capital where: Let’s take a look at an example of that formula in the real world.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title free cash flow formula from net income by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

Category

Related By Category

- 26+ Blue hibiscus flower tattoo meaning for Desktop Background

- 24++ Flower hair band images for Homescreen

- 37+ Data flow diagram examples in software engineering for Desktop Background

- 17++ Furnace air flow switch for Desktop Background

- 45++ Flow past tense meaning for Windows Mobile

- 44+ Anemone flower meaning betrayal for Android Phone

- 25+ Flower mandala coloring pages for adults for Homescreen

- 17++ Artificial flower pot price for Homescreen

- 22+ Black rose flower price for Desktop Background

- 33+ Cute flower canvas paintings for Desktop Background